Gross Monthly Income: How to Calculate and 5 Examples

How much money are you earning? It's important to know your gross monthly income for several purposes, including budgeting and securing loans. Here's how to calculate it.

What Is Gross Monthly Income?

Gross income refers to your total income before taxes and other items, such as health insurance from your employer, are deducted.

When a prospective employer offers you your starting salary, the figure is generally your gross annual income if you’re a full-time, salaried employee or gross hourly wage or project-based wage if you’re a part-time or freelance employee. Gross monthly income refers to the total sum of all your wages in a given month before deductions, so if you have multiple sources of revenue, together they constitute this figure.

What Is Net Monthly Income?

Net monthly income is your total income minus taxes and other deductions. Once taxes and other deductions, such as health insurance and other benefits, are taken out of your paycheck, you have your net monthly income. If you are a 1099 employee, your taxes are not deducted from your paycheck and you will receive the gross amount from that particular employer.

What Is Discretionary Income?

Discretionary income is your leftover income after paying for your essential expenses, including rent or mortgage, utilities, and food. It comes out of your net income, as opposed to gross income.

It’s always important to have a budget accounting for your necessary expenses to give you an idea of how much you can afford to put in your savings and how much is left over for your discretionary spending, which might include meals at restaurants, movies and other entertainment, clothes, and more. Try the 50 20 30 budget method to help you figure it out.

If you’re in debt, lose your job, or suffer any kind of financial crisis, reducing your discretionary spending is your first step toward a solution, since this income is non-essential, while utilities, food, and housing are.

When Do You Need to Know These Numbers?

Beyond simply giving you peace of mind to know how much money you’re earning after deductions, your gross monthly income is a figure that’s used in several different contexts. When you’re applying for loans, such as a mortgage, lenders will use this figure to help determine how much you can borrow. (In many instances, the amount you can borrow won’t exceed more the 28% of your gross monthly income, according to Bankrate.)

When you’re applying for credit cards, the companies will also want to verify your income to determine both if you qualify and what your credit line should be.

How to Calculate Your Gross Monthly Income

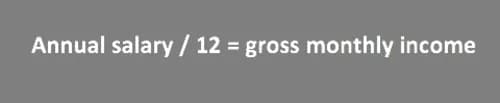

For Salaried Employees

It is pretty simple to calculate your gross income if you receive an annual salary. Simply divide your total gross annual salary by 12, and you have your gross monthly income. Of course, if you have other sources of income, such as a side hustle or investments, you will need to factor those in as well.

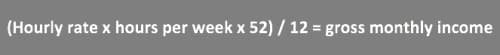

For Hourly Employees

If you are an hourly employee, you’ll need to make a few more calculations. Determine how many hours you work in a typical week and multiply the figure by 52. Then, divide the total by 12. This is your gross monthly income from this job. This can be tricky to calculate if you don’t have a set number of hours per week, so try to find an average estimate to use for the calculation.

In both instances, if you receive additional income from sources such as bonuses or overtime, investments, or other sources, it’s best to add the figures together for a given year and divide the sum by 12. Add the result to your income from your job(s).

Examples

Salaried Employees

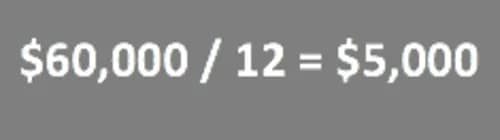

Example #1

Mary has an annual salary of $60,000 and no additional sources of revenue. To find her gross monthly income, she will divide $60,000 by 12, for a total of $5,000.

Example #2

Tina earns an annual salary of $75,000 and has a side hustle that pays $100 per week. First, she will divide $75,000 by 12 for a sum of $6,250. Next, she will multiply $100 by 52 and divide the resulting sum (5,200) by 12, which gives her $433.33. Finally, she will add these figures together for a total gross monthly income of $6,683.33.

Hourly Employees

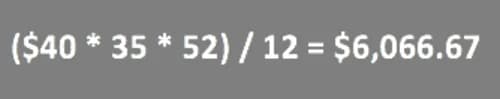

Example #1

Elizabeth earns an hourly rate of $40 per hour. She typically works 35 hours per week. To find her gross monthly income she will first multiply $40 by 35, which gives her $1,400. Then, she will multiply $1,400 by 52, for $72,800, her gross annual income. Finally, she will divide this figure by 12 for a gross monthly income of $6,066.67.

Example #2

Daphne works two freelance jobs, one of which pays by the hour and the other of which pays by the project. The hourly job pays $35 an hour, and she typically works about 20 hours per week. The project-based job pays $200 per project, and she usually completes two projects per week. To calculate her gross monthly salary, she will first multiply $35 by 20 and then multiply that sum ($700) by 52. She will divide that income ($36,400) by 12 for $3,033.33.

Then she will multiply her projects per week (2) by $200, and multiply that figure ($400) by 52, for $20,800. She will divide $20,800 by 12 for $1,733.33. Finally, she will add together her gross monthly income from the two jobs together ($3,033.33+$1,733.33) for a total gross monthly income of $4,766.66.

Is Your Gross Monthly Income After Taxes?

Your gross monthly income is the amount you earn before, not after, taxes are deducted. The post-deduction figure is your net monthly income—the amount of money you take home.

What is a Gross Monthly Household Income?

Your gross monthly household income is the total gross monthly income from all the streams of revenue of every member of your household, including income from all your jobs, bonuses and other income beyond your salary, investments, Social Security payments, and more. If you have a spouse or partner, your gross monthly household income includes your income and your partner’s. All income from all members of the household constitutes your gross monthly income.

For example, if you make $5,000 (gross) a month from your regular job and your partner earns $4,500 (gross), then your gross monthly household income is $9,500.

Why women love us:

- Daily articles on career topics

- Jobs at companies dedicated to hiring more women

- Advice and support from an authentic community

- Events that help you level up in your career

- Free membership, always