What Is a Pay Stub?: Examples and Explanation

Whether via electronic or physical means, chances are, you receive a pay stub from your employer. Offering details about your pay, including your gross wages, net pay, deductions and more, this document is chock full of important information about your income from a given employer.

While this document contains pertinent details, it can also be confusing to understand at first glance. What does all that information mean? How do you use it? Do you need to keep your pay stubs? We’ll break down the components and explain how to read and understand a pay stub below.

How to Read a Pay Stub

A pay stub has many different components. Below, we’ve outlined some common terms you’re likely to see on your pay stub and explained what each of them indicates.

(Keep in mind that some pay stubs may include some or all of the below information. Others may include other components or different terms for the pieces listed here.)

• Gross wages

Your gross wages are your total earnings for a certain period before deductions such as taxes are removed from them. They will represent your salary for that period but not the amount of money you’re actually taking home. Your gross pay will be your total annual salary divided by the number of pay periods within a year. So, if you’re paid monthly, your listed gross pay is your annual salary divided by 12. If you are paid hourly, this pay represents your hourly rate multiplied by the number of hours you work in the pay period.

• Taxes

W-2 employees have their taxes taken directly from their pay. Your pay stub will show itemized tax deductions, including federal FICA (encompassing Social Security), federal income tax, federal Medicare, state income tax, local taxes and others.

1099 employees do not have taxes withheld from their paychecks, so they will not see these deductions on their pay stubs.

• Employee Benefits

Any benefits you receive that require a portion of your income to be automatically deducted from your paycheck will most likely be itemized. These itemizations might include medical, dental, or vision insurance; contributions to retirement plans; life or disability insurance; and other benefits.

• Other Voluntary and Involuntary Deductions

Some deductions may be involuntary, such as child support payments and defaulted student loans. Taxes are also considered involuntary deductions. These are payments you are legally required to make, as opposed to voluntary deductions such as insurance and contributions to retirement plans.

• Net Pay

After your deductions are taken out of your gross pay, you’ll be left with your net pay. This is the amount you’ll actually receive in your paycheck.

• YTD Earnings

Some pay stubs will list your year-to-date (abbreviated YTD) earnings, including gross pay, deductions, and net pay for the year so far.

• Current Earnings

Current earnings are a summary of the breakdown of your pay for the particular period represented by the pay stub, including your total gross pay for the period, deductions and net pay.

Pay Stub Example and Explanation

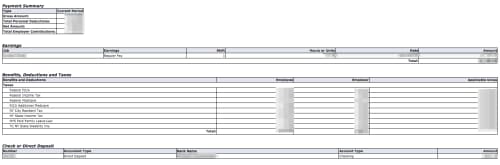

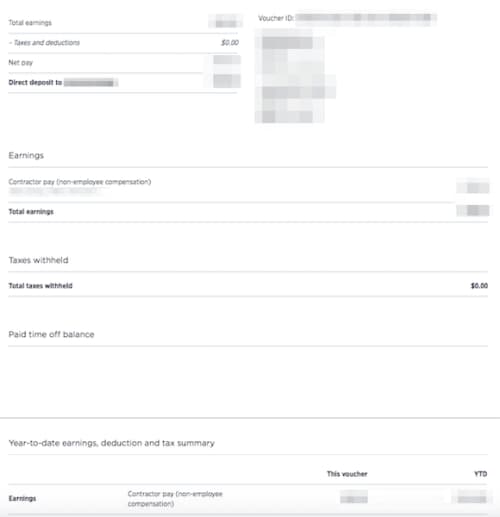

Below are examples of a pay stub for a W-2 and 1099 employee respectively.

W-2 Employee Pay Stub

This pay stub offers a summary of deductions, including the gross amount, total personal deductions, the net amount, and total employer contributions. It includes a breakdown of the taxes deducted, as well as the rate of pay per hour and the number of hours worked.

1099 Employee Pay Stub

This pay stub offers a summary of earnings for the period and the year to date. Note that no taxes are withheld from this paycheck, since 1099 employees do not have them deducted from their earnings and must pay their taxes either quarterly or annually, depending on the amount of their earnings from given employers. There are no other deductions listed, because 1099 employees are generally (but not always) freelancers who do not receive benefits such as insurance or contribute to retirement plans.

FAQs

1. How do you get your pay stub?

Your pay stub comes from your employer. Your employer may deliver it to you physically, store it in an online database (if you have an employee portal, you should check there, since that’s the place it’s most likely stored), or send it to you by email.

If you can’t find your pay stub or aren’t sure if your employer has provided one to you, you should ask your manager, a human resources representative or a contact from your company’s payroll department about how you can obtain one.

2. Does my employer have to give me a pay stub?

Federal law does not require your employer to provide you with a pay stub. However, some states do.

No requirement states include:

• Alabama

• Arkansas

• Florida

• Georgia

• Louisiana

• Mississippi

• Ohio

• South Dakota

• Tennessee

“Access” states requiring the provision of a pay statement detailing wage information include:

• Alaska

• Arizona

• Idaho

• Illinois

• Indiana

• Kansas

• Kentucky

• Maryland

• Michigan

• Missouri

• Montana

• Nebraska

• Nevada

• New Hampshire

• New Jersey

• New York

• North Dakota

• Oklahoma

• Pennsylvania

• Rhode Island

• South Carolina

• Utah

• Virginia

• West Virginia

• Wisconsin

• Wyoming

States requiring the provision of the option of a print pay statement include:

• California

• Colorado

• Connecticut

• Iowa

• Maine

• Massachusetts

• New Mexico

• North Carolina

• Texas

• Vermont

• Washington

Employers in Delaware, Minnesota, and Oregon may provide this information digitally, but must provide a paper statement if an employee requests one. In Hawaii, employers must ask employees for permission to provide this information digitally.

Furthermore, according to the Fair Labor Standards Act, your employer must keep records of your wages work hours, and you may request access to these records.

3. Is pay stub the same as pay statement?

Yes, your pay stub and pay statement (also called earnings statement) are two terms for a document detailing a record of your payments from an employer. “Pay stub” is called such because a pay statement is attached to your physical paycheck, and you can detach it for your records and take the check to the bank for deposit. Today, most employers direct-deposit employee’s earnings and deliver the pay stub electronically.

4. Do I need to keep my pay stubs?

It’s a good idea to hold onto your pay stubs for your records. You may need to review them for accuracy when you file your taxes each year.

If you have electronic pay stubs, you can hold onto them indefinitely. You should store physical pay stubs for at least a year after you receive them. If you discard them, make sure you shred them or remove any identifying information.

Don’t miss out on articles like these. Sign up!

Why women love us:

- Daily articles on career topics

- Jobs at companies dedicated to hiring more women

- Advice and support from an authentic community

- Events that help you level up in your career

- Free membership, always